House Appraisal Under Purchase Price

But if the appraised value is under be prepared to come to the table with more money. Lets throw out a few different scenarios to highlight how the appraisal impacts financing when getting the house ready for an appraisal.

Appraisal Contingency For Nyc Real Estate Hauseit Nyc Real Estate Appraisal Purchase Contract

Subtract your down payment 20000 from the total selling price 150000.

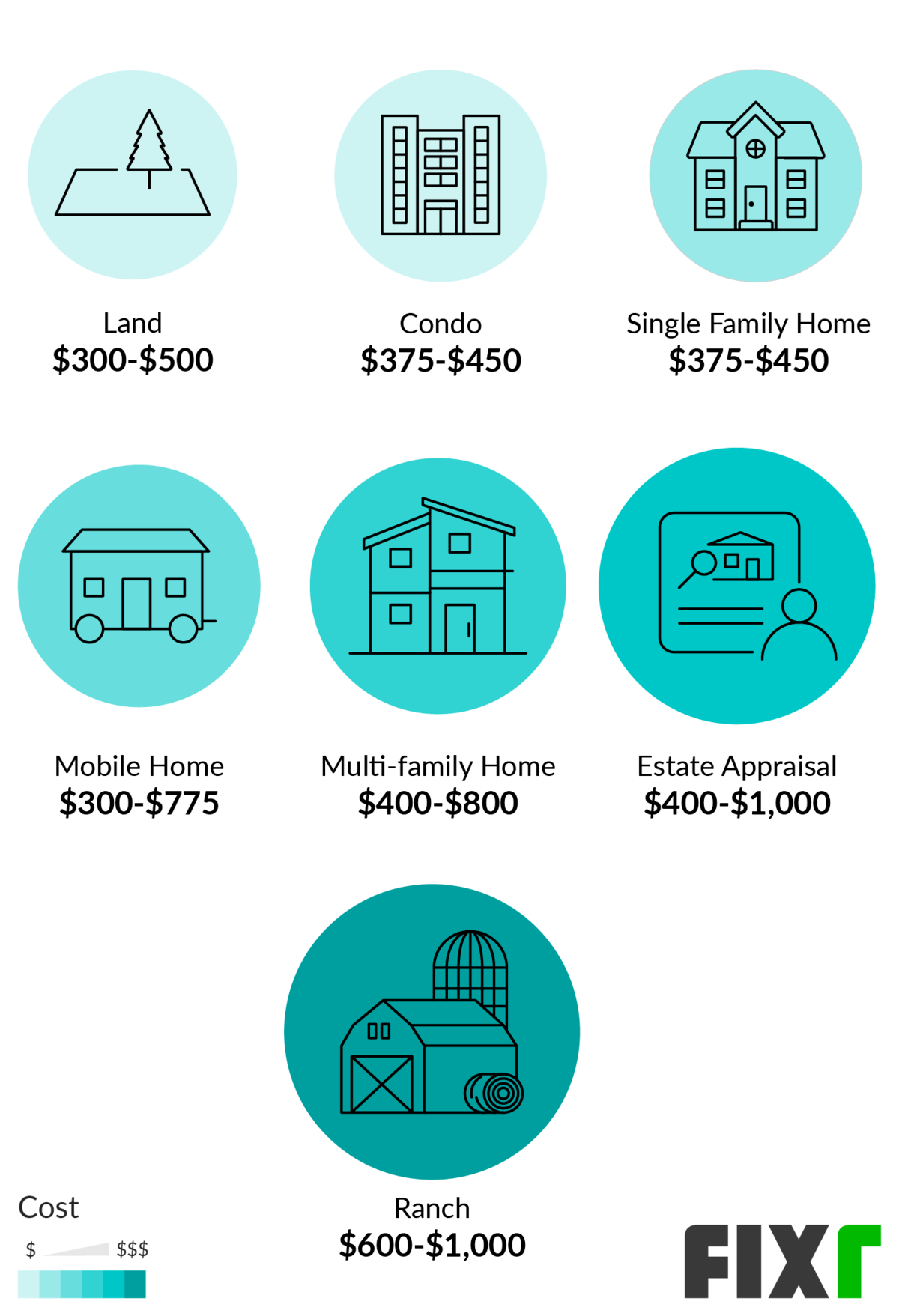

House appraisal under purchase price. For the sake of simple math lets say the property is under contract for 410000 but the appraisal comes in at 400k. For example assume 6000 in closing costs and pre-paids. Having an FHA home appraisal come in below the purchase price is a fairly common scenario.

Explain that you are not willing to pay more for a house than it is worth in the current market. If it is selling for 450000 you come in at 460000. Real Estate in the District recently sold a renovated Chevy Chase Md farmhouse for 154 million after a bidding war raised the price from the 1495 million listing.

What To Do When House Appraisal is below Purchase Price Published on - 6192021 74737 PM In todays booming housing market sellers have their pick of home offers. If the home will not appraise for the purchase price it means the lender will not agree to lend a high loan-to-value balance. According to a study by.

Of course if the offer is cash there typically is no appraisal. What if the appraisal is lower than purchase price. Using the purchase price of 200000 and the appraised value of 210000 the price could be renegotiated to 206000 with 6000 in seller paid closing costs.

A low appraisal is bad news because the lender will only provide a loan up to the appraised value overriding your agreed-upon purchase price. They can ask the buyer to bring cash to the table to make up the difference in a competitive sellers. For example if I buy a house for 100000 but its tax appraisal is 80000 would I pay taxes based on what I paid for the house or based on the tax appraisal.

And likely the house will continue to increase value in this market and reach there in no time. Dec 02 2013 15403 Views Property. Thats 20 bucks a month.

You can make up the difference between the appraisal value and the sales price with cash if you have it. You and the seller agree that youll buy the home for 150000. When I bought my house three months ago I offered an appraisal gap of 20k.

The seller has a 10000 shortfall on their hands. The home youd like to buy is appraised at 150000. Now my house is worth 100-200k more then what I paid for.

In addition you tell your mortgage lender that youre making a down payment of 20000. The best offer to accept is the offer that is likely to close escrowwhich means it might not be the offer with the highest sale price. Give them a copy of the appraisal report if you have one.

Of course that probably doesnt make you feel any better You basically have three options. 7k is nothing to haggle over at least for a purchase that you will be paying 30 years for. You could get a loan for the appraisal amount and then pay the difference out of pocket.

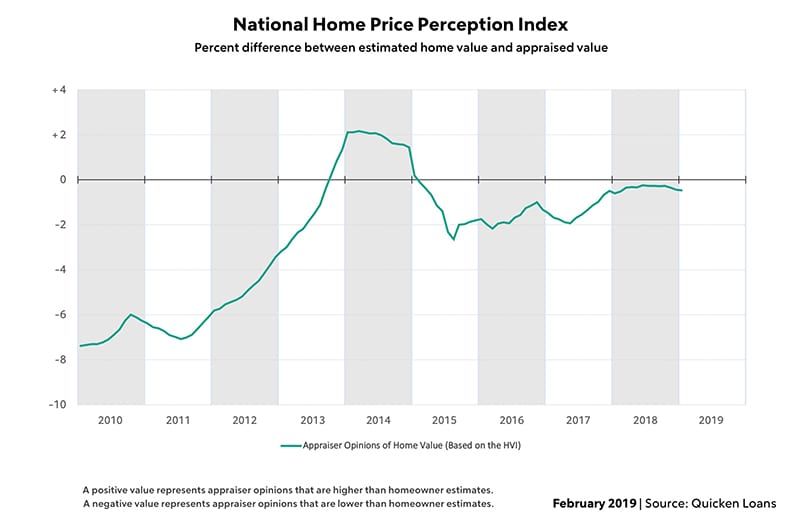

Going back to the example provided earlier who covers the 10000 discrepancy between your offer of 390000 and the appraisal of 380000. In a purchase-and-sale transaction an appraisal is used to determine whether the homes contract price is appropriate given the homes condition location and features. The lender only cares about the appraisal to the extent that it affects the loan-to-value ratio which is how much of the homes value the mortgage takes up such as a ratio of 75 or a loan of 75000 on a 100000 house.

The seller can reduce the sale price to match the appraised value. The final LTV is set when the appraisal arrives and determines the value. If the home is being purchased for 400000 and the loan amount is 380000 then the initial LTV is 95 380000 400000.

Depending on the interest rate and possible PMI its likely that the monthly payment would increase 25 40 per month. Evers Co. Seems a little rigged to me Ever had a client get really upset when you asked to see the purchase contract before you begin working on the appraisal.

Or just tell them the house appraised below the agreed-upon purchase price. The first thing you should do as a home buyer is put the ball back into the sellers court. If the house is selling for 200000 you come in at 202000.

Heres how to calculate your LTV.

Pin By Ryan Lundquist On Interesting Real Estate Home Appraisal Appraisal Home Ownership

What Does An Appraiser Look For Real Estate Info Guide Home Appraisal Home Selling Tips Real Estate

What To Do If Your Home Appraisal Comes Back Low Home Appraisal Selling Real Estate Home Buying

The Home Buying Road Map How To Buy A House Frederick Real Estate Online Home Buying Process Home Buying First Time Home Buyers

Azalea Lakes Baton Rouge Home Prices 2019 Baton Rouge Home Appraisal House Prices

Pin By Beautiful Child On Before And After Home Remodels Rehab House Flipping Houses Kitchen Remodel Images

House Appraisal What Is Real Estate Appraisal How To Get Home Appraised

Mortgage Ltv Definition Loan To Value Is The Of Your Loan Compared To The Lessor Of The Purchase Price Or Appraised Mortgage Mortgage Tips In This Moment

Is A Low Appraisal Good For The Buyer

Reasons Why An Appraisal Comes In Low Real Estate Advice Mortgage Refinance Calculator Real Estate Tips

Appraisal Is Higher Than My Loan Real Estate Info Guide Appraisal Home Mortgage Second Mortgage

Ten Tips For High Value Home Appraisals Home Appraisal Home Selling Tips Appraisal

9 Tips To A Higher Home Appraisal Home Appraisal Appraisal Refinance Appraisal

Tips To A Higher Home Appraisal Home Appraisal Appraisal Home Selling Tips

The Appraisal Came In Low Now What Zillow

Appraisal Contingency An Immersive Guide By The Floods Real Estate

Post a Comment for "House Appraisal Under Purchase Price"